Think about this: in just about any given market sector you’ll end up finding that only three companies dominate. In aviation, United, Delta and American Airlines control about 70% of the market share. The remaining 30% is held by all the other carriers. In telecom, AT&T, Sprint/T-Mobile, and Verizon control almost 100% of the market! I can go on … ok I will:

– In high-end retail: Nordstrom, Bloomingdale’s, and Saks Fifth

– In personal computing: Lenovo (formerly IBM), HP, and Dell

– Burger fast-food: McDonalds, Burger King, and Wendy’s

– Social media: Facebook/Instagram/WhatsApp (yes its all one company), Twitter, and Snapchat

– Pay-TV television: AT&T, Comcast, Charter Communications

Some of these companies (like AT&T) hold dominant market share in multiple industries, like television and telecommunications.

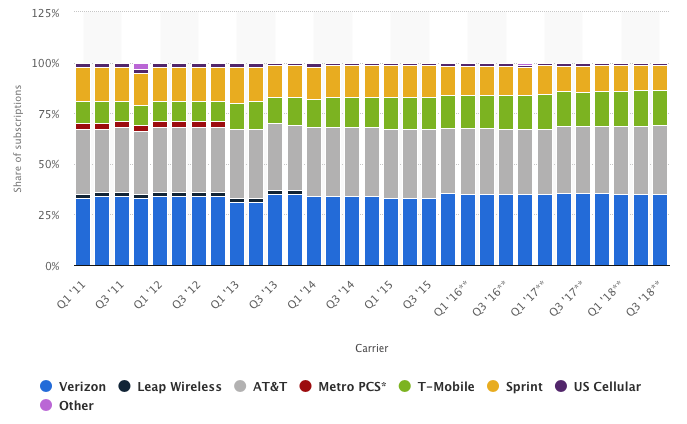

Wireless carrier market share as of 2018. The top three carriers (T-Mobile and Sprint will soon be one company) is almost 100%.

We call these tripartite arrangements oligopolies. Unlike monopolies where one company dominates a market, an oligopoly consists of a handful of companies (usually three) that end up having a significant influence on an industry. Today the problem is not just an oligopoly in an industry or two, but dozens of oligopolies throughout the country. Everywhere you look, out pops an oligopoly.

Why is this important?

As companies merge (Comcast bought Time Warner, T-Mobile is buying Sprint) they have little incentive to remain competitive. In fact, they are incentivized to raise prices as high as possible to pay for the cost of a merger or to deliver even higher returns to shareholders. The highly consolidated American high-speed internet industry provides the clearest example of this trend: In 2014 Americans were already paying more than double what European consumers paid for high-speed broadband internet. This number has only risen in the past five years.

It’s not just consumers who lose out, but also vendors that sell goods to these companies and the employees who work there. Apple, Wal-Mart, Amazon and other dominant companies have been known to continually suppress wages of workers well-below normalized market rates and pay their vendors and suppliers as little as possible. The money they save remains idle or generates dividends for the company’s shareholders. For instance, Apple is currently sitting on $240 billion dollars of cash, not including other assets like inventory, land etc. … just cash … $240 billion of it! If Apple were a country, it would be one of the 50 wealthiest nations in the world based on cash reserves alone.

The effects of consolidation and diminishing competition filter down to the community level. Workers make less and the products they wish to purchase with their diminishing wages cost more. It’s a vicious cycle. Low wages force employees to work longer or take up second jobs (Americans already work more than counterparts in any other industrialized nation). Ultimately this means less time spent on healthy activities, less attention paid to raising children, and less cognitive bandwidth devoted to civic activities like making informed voting choices.